An expert guide to the Griffith's Valuation

4-5 minute read

By The Findmypast Team | March 3, 2016

In this special guest post, Fiona Fitzsimons, Irish genealogy expert and director of Eneclann shares her insights into getting the most of the Griffith's Valuation records - all of which are exclusively available at Findmypast.

And remember - allof our Irish records are completely free until March 7th. Take advantage and explore this amazing record set today!

Griffith's Valuation is one of the 'hidden treasures' of Irish genealogy, all the more surprising because it's so well known, by reputation.

It's not a single document - Griffith's Valuation includes over 300 books and original maps. It is a detailed record of Irish landholding surveyed from 1846, and published between 1847 and 1864.

Before 2003, no complete set existed, simply because no archive or library had the complete records.

The only complete version of Griffith's Valuation is on Findmypast.

Incomplete versions of this source are available on other websites, but they don't include records of up to 500,000 people.

Another online version of Griffith's Valuation uses later editions of Ordnance Survey maps that date from forty to eighty years afterwards. By the early 1900s the Irish population had fallen by more than half, and these later maps don't show the farms and homesteads documented in the original survey.

Online access to a definitive version of Griffith's Valuation, should have popularized it. Unfortunately many people still use it only as a 'census-substitute'.

If this is your only use, then you're not getting the full benefit of this marvelous source.

Interpreting the evidence in GV

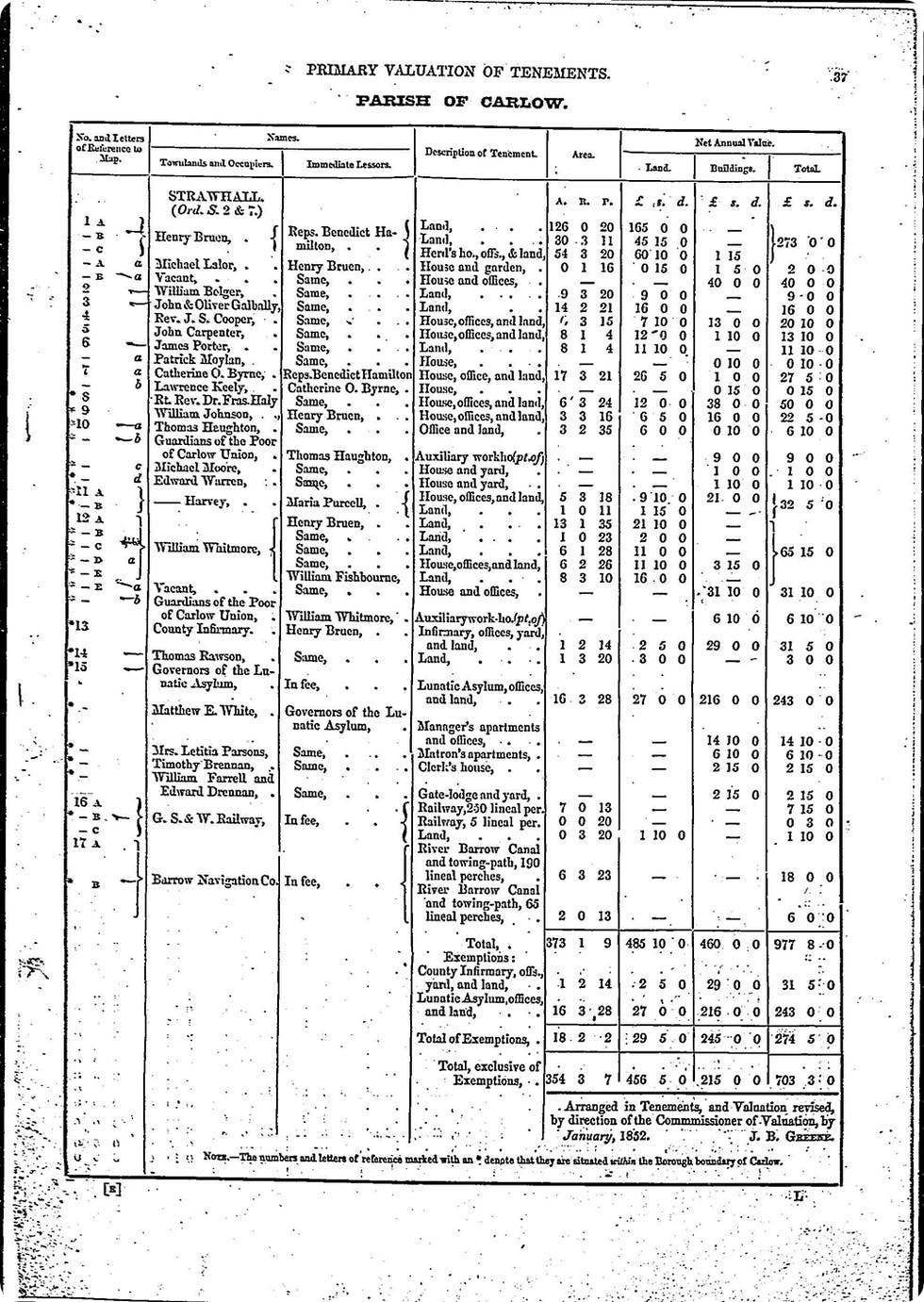

Column 1 'Number and letters of reference to map.'

This is the reference number for every piece of property in a townland (generally the smallest administrative division of land in Ireland).

Use this number to 'navigate' between the printed books and the maps.

Capital letters A, B, C, D etc. represent parcels of the property divided by soil type.

Lower case italicized letters indicate houses on the land plot.

An italicized lower case 'a' denotes the house of the main householder.

All other italicized letters b, c, d, e, etc. are used to identify habitable houses on the same plot.

Column 2 'Townlands and occupier.'

This has the name of the occupier – the person living on the land, often a tenant.

Column 3 'Immediate Lessors.'

This is the name of the landlord, or sometimes the middleman who sublet a holding.

If land is held 'in fee', then the occupier owns the land.

Occasionally there is no name in column 3, but instead you will find a comment 'Reps. of …', or 'in chancery.'

There were very many reasons why this might happen.

Column 4 'Description of tenement.'

This describes the piece of land set to rent, defined in legal terms as a 'tenement.'

Sometimes the quality of the soil is noted, usually where the land is marginal, and this is stated in italics: 'Land (bog)' or Land '(mountain).'

Columns 5 defines the area of the land in acres, roods and perches.

A rood is about the size of a potato patch.

Columns 6-8 sets out how much income the tenement can produce each year. This yearly income was the basis of the property tax, popularly known as rates.

The bureaucrats that ran the scheme referred to the tax as the Annual Rateable Valuation (A.R.V.).

The A.R.V. was charged in old pounds, shillings and pence - £.s.d.

Column 6 is the yearly tax charged on the land component of the tenement,

Column 7 is the yearly tax charged on all buildings on the tenement.

Column 8 is the sum of tax charged on the land and buildings.

By knowing the A.R.V. – the annual rateable valuation of the house your ancestors lived in, you can determine a lot about their living conditions.

Property is always more expensive in the cities than in rural areas.

A grand Georgian House on one of the fashionable streets in Dublin had an A.R.V. of between £50 and £75.

A country house with an A.R.V. of £40 or over was a mansion house.

In the countryside, including villages any house with an A.R.V. of £5 or more, was built of stone or brick with a slate or tile roof. It would probably have had a minimum of six rooms over two or more levels.

Houses with an A.R.V. of between £2 and £5 were smaller.

The walls were probably built of stone or brick.

Houses on the upper-end of this scale i.e. £4 to £5 might have two levels.

Houses on the lower-end i.e. £2 to £2.5s might have a 'dormer' level, and a thatch roof.

Houses with an A.R.V. of less than £2 were smaller cottages of 2 and 3 rooms.

At the very bottom of the scale you'll find houses taxed at 8s, 10s and 15s. These are the one and two room mud-cabins, with a thatch or turf roof.

* * * *

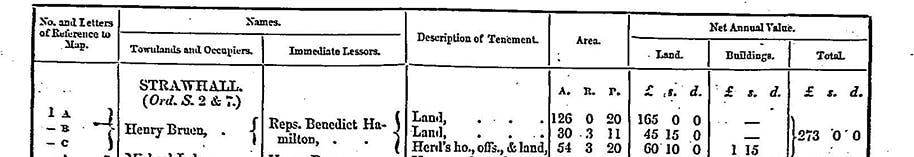

Here's an image of a page from Griffith's Valuation:

Townland of Strawhall, parish of Carlow, county Carlow.

Here's how we can interpret this document, for Henry Bruen, the first person listed in Griffith's Valuation for Strawhall:

In the townland of Strawhill Henry Bruen leased three tenements from the Representatives of Benedict Hamilton,

Bruen sub-let a cottage on Lot 1A, to Michael Lalor, who was Bruen's main tenant.

A large mansion-house, presumably Benedict Hamilton's own residence, was left vacant on Lot 1B.

Bruen also left the herd's house vacant on Lot 1C.

Bruen paid £273 in annual tax, of which £3 was for the buildings, and the remainder for land.

Griffith's Valuation as a gateway source to other records

Griffith's Valuation is a 'gateway' source for other records, many of which are already available on Findmypast. Check outour top 5 essential record sets for discovering your Irish heritage.

Related articles recommended for you

Here's how to research the double-barrelled surnames in your family tree

Help Hub

Doctor Who season 14: digging into the new Doctor's family tree and more

Discoveries

The history of the Christmas tree: how Queen Victoria introduced America to the Christmas tree

History Hub